In this article, we’re going to show you how to deal with a debt collection agency – and those nasty debt collectors that come calling at all hours, contacting your friends and relatives, and are generally harassing you. Read on to find out more about your legal rights in this situation. We know there are a lot of people still coping from the great recession, and we’re here to help sort out that mess with the options that you have. Use this at your own discretion, and understand the potential pitfalls of going this route.

Dealing with Debt Collectors

Sometimes dealing with debt collectors just makes you want to scream.

Are you being harassed by debt collectors or other agencies? Well, we’re here to let you know your rights when dealing with these types of people, and how to avoid these situations in the future.

If you owe money to places such as mortgage companies, credit card agencies, or even for your student loans, there are options to help repay. You can get in writing from them and negotiate how to best settle your bills. Ultimately, it’s at their own discretion on how to settle your debt with them.

Sometimes this debt will be sent to an outside company which will reach out to you to try to collect as much as possible. City governments and credit card companies sell your debt for pennies on the dollar so they get some money, while the collection department pursues the rest of it hoping to make more than they shelled out. Knowing this information will allow you to be ahead of the game when negotiating, knowing you don’t necessarily have to pay back the ‘full amount’.

Some tips – Never give out your personal phone number (best bet would be to use a Google Voice Number) and never give out your checking information. This can cause endless harassment by calling you, and have them take out more money than they said they would. Using these tips you can save yourself some headache in the future.

If you did however give out your personal number, we know how shady these agents can be. Here are some legal tips to fight them. Warning: use these at your own discretion!

Fighting Debt Collectors

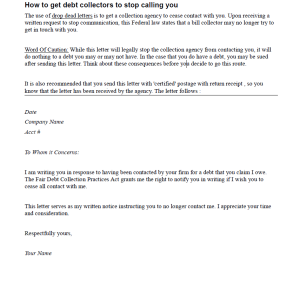

Put simply, fill out and mail a “Drop Dead Letter” to the collection agency. This literally tells the collection firm to ‘drop dead’ and to stop contacting you. Thanks to the Debt Collection Fairness Act, you can legally notify an agency to stop contacting you. There are several negatives you should consider before doing so. The collection agency could be trying to contact you in how to save your home, for example if it was a bank that held the note and deed to your home. These companies can also choose to sue instead of working with you to repay, so use this in the most extreme cases, or if the debt collectors are rude and harassing. Click on the above link to fill out our Drop Dead Letter we created for your use.

Submit A Complaint

The Consumer Financial Protection Bureau was created in July of 2011, meant to help protect consumers with their financial issues. They have a form where you can submit a complaint if agencies still harasses you. After sending the above letter, it may even give you the ability to reach out to a lawyer and have them send a cease and desist letter, and you can pursue damages in small claims court for the violation. The link to the complaint form is here.

Sample Drop Dead Letter To Collection Agencies

You can use this sample drop dead letter when reaching out to collection agencies. Fill out your own name, date, and account number to send it. Don’t forget to get a “read receipt requested” by sending it via certified mail.

Be aware of the potential pitfalls and consequences of going this route, and we hope that you can get even with these debt collectors. Sorry this wasn’t a humorous way to get your revenge, but with thought we’d share this important and necessary information to our readers. In the future we will probably do one that is humorous to say telemarketers or slick snake oil salesmen, which you may certainly appropriate for use with these debt collectors. What ever you choose to do, we here at How To Revenge wish that you live a very pleasant life, and are able to get even when it counts. Until next time fellow readers!

Call them back repededly…. Use a whistle.